Canadians Injured In the U.S.A

Cross Border Car and Motorcycle Accidents

WHAT ARE MY RIGHTS IF I AM A CANADIAN INJURED IN THE USA?

Canadians travel to the United States frequently, for vacations, business and countless other reasons. Unfortunately, accidents can happen anytime and anywhere. It is especially difficult to deal with a serious accident when you are in another country, which means a different legal jurisdiction. If you are injured in a car accident while in United States, there are remedies available to compensate you for your losses.

Fortunately, Canadians will often be able to access insurance benefits through their own insurance company, even for car accidents that occurred in the United States. In addition to obtaining accident benefits or disability insurance payments from your Canadian insurer, you may also be able to claim against the insurance company for the other vehicle/driver in the United States.

If you are an Ontario resident, and were injured in a car accident in the United States, there is a chance that the at fault party may be uninsured or underinsured. That is, the other driver's insurance limits may not be sufficient to pay for your claim. Many States have lower minimum insurance requirements for drivers than Ontario. In those situations, you may be able to advance a claim in Ontario, Canada for the uninsured and underinsured benefits that form part of your Ontario motor vehicle insurance policy.

Cross border personal injury cases can be complex and you should not delay in consulting a Ontario personal injury lawyer to make sure your rights are fully protected.

Experienced Lawyer for Ontario and US Car Accident Claims

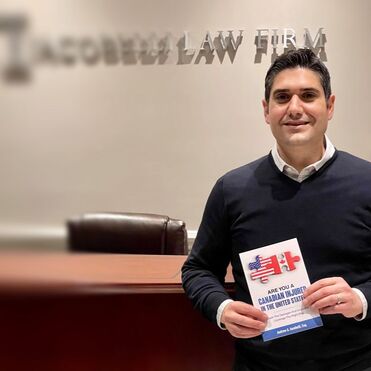

Ontario lawyer Andrew Iacobelli obtained his Juris Doctor degree (cum laude) from Michigan State University and he is licensed to practice law in the province of Ontario and in the State of Michigan and State of Florida. Andrew is also admitted to practice in the United States Federal Courts for the Southern, Middle and Northern Districts of Florida, and the United States Eleventh Circuit Court of Appeal. Before returning to Ontario, Andrew litigated serious personal injury, wrongful death, and insurance bad faith claims in the United States. Andrew has established a network of legal professionals in the United States with whom he is able to co-ordinate legal proceedings which must be conducted in the United States. Andrew is the author of the book for Canadians Injured in the USA, tiled "Are You A Canadian Injured in the United States? Claim the Damages and Insurance Coverage the Right Way."

We are highly experienced in cross-border claims involving Ontario residents injured while travelling in the United States. With our access to lawyers and offices in both Canada and the United States, we have the expertise and resources to help you navigate your claims on both sides of the border.

Canadians travel to the United States frequently, for vacations, business and countless other reasons. Unfortunately, accidents can happen anytime and anywhere. It is especially difficult to deal with a serious accident when you are in another country, which means a different legal jurisdiction. If you are injured in a car accident while in United States, there are remedies available to compensate you for your losses.

Fortunately, Canadians will often be able to access insurance benefits through their own insurance company, even for car accidents that occurred in the United States. In addition to obtaining accident benefits or disability insurance payments from your Canadian insurer, you may also be able to claim against the insurance company for the other vehicle/driver in the United States.

If you are an Ontario resident, and were injured in a car accident in the United States, there is a chance that the at fault party may be uninsured or underinsured. That is, the other driver's insurance limits may not be sufficient to pay for your claim. Many States have lower minimum insurance requirements for drivers than Ontario. In those situations, you may be able to advance a claim in Ontario, Canada for the uninsured and underinsured benefits that form part of your Ontario motor vehicle insurance policy.

Cross border personal injury cases can be complex and you should not delay in consulting a Ontario personal injury lawyer to make sure your rights are fully protected.

Experienced Lawyer for Ontario and US Car Accident Claims

Ontario lawyer Andrew Iacobelli obtained his Juris Doctor degree (cum laude) from Michigan State University and he is licensed to practice law in the province of Ontario and in the State of Michigan and State of Florida. Andrew is also admitted to practice in the United States Federal Courts for the Southern, Middle and Northern Districts of Florida, and the United States Eleventh Circuit Court of Appeal. Before returning to Ontario, Andrew litigated serious personal injury, wrongful death, and insurance bad faith claims in the United States. Andrew has established a network of legal professionals in the United States with whom he is able to co-ordinate legal proceedings which must be conducted in the United States. Andrew is the author of the book for Canadians Injured in the USA, tiled "Are You A Canadian Injured in the United States? Claim the Damages and Insurance Coverage the Right Way."

We are highly experienced in cross-border claims involving Ontario residents injured while travelling in the United States. With our access to lawyers and offices in both Canada and the United States, we have the expertise and resources to help you navigate your claims on both sides of the border.

First Steps That A Resident Of Ontario Injured In The US Needs To Take

Learn about important steps to take immediately if you are a Canadian injured in the United States

Election of Accident Benefits if Injured in a Car Accident in the United States

"I had a great experience with this firm from my car accident. Cross-border claims can be difficult but the team here was excellent in helping to navigate a very fair settlement. Highly recommend."

What Do You Do if the US Insurance Policy Has Low Policy Limits?

Often times, the insurance policy on the US vehicle that caused the accident and resulting harm and injury will have low coverage limits in comparison to Canadian insurance policies. Most of the Ontario policies we see have coverage of One Million Dollars or more. Policy limits that high are exceptionally rare in the United States for personal vehicles. In fact, many of the US insurance policies we see are well under One Hundred Thousand Dollars, and commonly as low as Ten Thousand or Twenty Thousand Dollars. Fortunately, if you are an Ontario resident, you likely have protection in the event of an underinsured or even uninsured motorist (UM UIM) causing an accident. The Ontario insurance policy will cover your losses in excess of the policy limits available from the at-fault driver's insurance.

What Do I Need To Do To Claim for Underinsured Coverage?

If you have underinsured claim, you will need to file a lawsuit against the Ontario auto insurance company in an Ontario Court for the harms and losses caused by the at-fault driver. These claims are more complex because certain provisions of the US state law will apply, even though the case is proceeding in Ontario. Our firm regularly represents Canadians in underinsured cross-border injury claims, and we estimate that we are among the leading law firms in Ontario for these kinds of claims. Many of these claims come to us from American attorneys that are trying to secure the underlying policy limits and need guidance on preserving and advancing the Underinsured Claim. Among the complexities in these cases is the fact that UIM claim must be advanced in Ontario Court as per the insurance contract.

If the US Insurance Carrier Has Tendered Limits, You Must Preserve Your UIM Claim in Ontario

If the US insurance company has tendered its limits, they will want a signed release in favor of their named insured(s). This is a release that bars any claim against the at-fault driver and vehicle owner in exchange for the money paid by the insurance company. It may be tempting to immediately accept this settlement money in US Dollars and sign the paperwork. Be careful, do not act too hasty. Get the advice of an experienced cross-border injury lawyer than regularly handles Underinsured Claims. We do this all the time, and are often educating the Ontario insurance adjusters and their lawyers about the process. Although Ontario law does not explicitly require it, as a good practice it is important to put the Underinsured motorist carrier on notice of the tendered limits and proposed release. Our practice is to give the Ontario insurer at least 30 days notice and an opportunity to choose between consenting to the release and acceptance of the funds or, alternatively, advancing the same amount of money to the client. In doing so, we are giving the Ontario insurance company the opportunity to preserve their rights to subrogation. This is a right that the Ontario insurers have if they make payment to you because the at-fault driver did not have enough insurance coverage. In our experience, the Ontario insurer will almost always consent to the release and acceptance of the underlying policy limits. In some, rare instances, the Ontario insurance company might not want to make a decision either way and just ignore the notice. In those cases, if the circumstances warrant, we will usually conclude the matter with the US insurer and file a lawsuit in Ontario for UIM coverage. The insurance company cannot prevent you from making a good faith and bonafide settlement with the at fault driver unless it is willing to make a payment to you. That is, the Ontario insurance company cannot have it both ways. If they want to preserve their subrogation claim, they must advance the payment offered by the US insurance company to you. In doing so, they are not even taking on any risk at all because they can always recover the same amount from the at-fault driver's insurance company at a later date.

Where do You file the Underinsured or Uninsured Motorist Claim if the Accident Happened in the United States?

If you are an Ontario resident and the at-fault driver has insufficient insurance to pay your claim, you may have the ability to commence a claim for Underinsured or Uninsured motorist coverage from your Ontario auto policy. Even though the accident may have occurred in one of the United States, the underinsured claim is brought in Ontario. There are also time limits that you must adhere to in order to bring a underinsured motorist claim in Ontario.

Which Law Applies in the Underinsured Claim - Ontario or the State where the Accident Occurred?

The choice of law provisions on Underinsured or Uninsured motorist claims arising from a US accident are often misunderstood by insurance adjusters and even their lawyers. In short, the law of both jurisdictions will apply. The legal maxim to start with is that of Lex Loci Delicti - a Latin phrase that essentially means that the law of the location where the negligent conduct occurred. In the case of a Canadian injured in a Florida car accident the, we begin with the proposition that the law of Florida will apply even though the claim is advanced in an Ontario court. This is not the end of the story, however. The Ontario insurance contract provides that Ontario law on damages applies. Furthermore, even where Ontario courts apply a foreign law, the Ontario law on procedure will always apply. Canadian courts have held that Damages/Money awards are procedural law. So, in the context of a Canadian injured in the US, the Courts will apply the US law with respect to liability under the doctrine of Lex Loci Delicti, and will apply Ontario law on damages on the basis of the contract and the common law interpreting damages as procedural law.

What is the Deadline to File a Uninsured or Underinsured Claim?

The applicable statute of limitations for UIM claims and when the limitation begins to run has been the subject of considerable debate and legal analysis by the Courts. The leading case in Ontario is from the Court of Appeal decision in Schmitz v. Lombard General Insurance Company of Canada, 2014 ONCA 88. That case addressed the application of the Limitations Act to claims under OPCF 44R. In Summary, the Court of Appeal held that the limitation period for claims under OPCF 44R start to run on the day after a demand for indemnity is made.

The Ontario Insurance Act Deductible and Threshold Are Liability Law and Therefore Do Not Apply to a UIM Claim Arising from a US Accident

The most significant implication is that the Deductible and Threshold under Ontario law do not apply to Underinsured Claims arising out of US car accidents. Under Ontario law, if a person is injured in a car accident, their claim is subject to two highly prejudicial provisions of Ontario law, namely the Deductible and the Threshold. The Deductible literally reduces the value of the case by a subjective amount chosen by the legislature, which increases every year. Currently the deductible is around $40,000. The Threshold is a provision that takes the power away from juries in Ontario and gives Judges the authority to wipe out verdicts for pain and suffering and health care expenses if they are not satisfied that the injury rises to the level of a permanent and serious impairment. This highly prejudicial Ontario law gives insurance companies a second bite at the apple even where a jury has awarded money to an injured victim. Fortunately, for victims of accidents in the United States, these two provisions of Ontario law do not apply to the Underinsured Motorist claim. The State law counterpart, however, will apply. As such, if the State where the accident occurred has a similar law that law would be applicable as a liability provision under the doctrine of Lex Loci Delicti. In our experience, dealing with Canadians injured all over the United States, we have not encountered any provisions that are anywhere near as prejudicial to a car accident victims right to compensation as those that presently exist in Ontario law. The leading case on this subject is from the Ontario Court of Appeal in Chomos v. Economical Mutual Insurance Co. 2002 CarswellOnt 2692; see also, Green v. State Farm Mutual Automobile Insurance Co. 2009 CarswellOnt 3770.

Can I Claim Ontario Accident Benefits - PIP Benefits if Injured in an Accident in the USA?

Ontario residents with a valid Ontario auto insurance policy, or those otherwise covered under an Ontario auto insurance policy (ie. family member in your household) will usually have the ability to claim for Ontario Accident Benefits even if the car or motorcycle accident occurred in the United States. This is important because Accident Benefits provide coverage even if you are at fault. Accident Benefits provide coverage for medical expenses and lost income, among other things.

If Injured in an Accident in the United States, You Have the Right to Elect Benefits from Ontario or the US

When an Ontario resident is injured in a car accident in the United States, they have the right to elect between Ontario benefits or those of the jurisdiction (State) where the car or motorcycle accident occurred. The election is final, so it is important to make an informed decision. In many cases, the choice can have major consequences to your ability to access benefits for healthcare and income loss. It is important to seek the advice of an experienced lawyer before making an election of benefits.

What Do I Need To Do To Claim for Underinsured Coverage?

If you have underinsured claim, you will need to file a lawsuit against the Ontario auto insurance company in an Ontario Court for the harms and losses caused by the at-fault driver. These claims are more complex because certain provisions of the US state law will apply, even though the case is proceeding in Ontario. Our firm regularly represents Canadians in underinsured cross-border injury claims, and we estimate that we are among the leading law firms in Ontario for these kinds of claims. Many of these claims come to us from American attorneys that are trying to secure the underlying policy limits and need guidance on preserving and advancing the Underinsured Claim. Among the complexities in these cases is the fact that UIM claim must be advanced in Ontario Court as per the insurance contract.

If the US Insurance Carrier Has Tendered Limits, You Must Preserve Your UIM Claim in Ontario

If the US insurance company has tendered its limits, they will want a signed release in favor of their named insured(s). This is a release that bars any claim against the at-fault driver and vehicle owner in exchange for the money paid by the insurance company. It may be tempting to immediately accept this settlement money in US Dollars and sign the paperwork. Be careful, do not act too hasty. Get the advice of an experienced cross-border injury lawyer than regularly handles Underinsured Claims. We do this all the time, and are often educating the Ontario insurance adjusters and their lawyers about the process. Although Ontario law does not explicitly require it, as a good practice it is important to put the Underinsured motorist carrier on notice of the tendered limits and proposed release. Our practice is to give the Ontario insurer at least 30 days notice and an opportunity to choose between consenting to the release and acceptance of the funds or, alternatively, advancing the same amount of money to the client. In doing so, we are giving the Ontario insurance company the opportunity to preserve their rights to subrogation. This is a right that the Ontario insurers have if they make payment to you because the at-fault driver did not have enough insurance coverage. In our experience, the Ontario insurer will almost always consent to the release and acceptance of the underlying policy limits. In some, rare instances, the Ontario insurance company might not want to make a decision either way and just ignore the notice. In those cases, if the circumstances warrant, we will usually conclude the matter with the US insurer and file a lawsuit in Ontario for UIM coverage. The insurance company cannot prevent you from making a good faith and bonafide settlement with the at fault driver unless it is willing to make a payment to you. That is, the Ontario insurance company cannot have it both ways. If they want to preserve their subrogation claim, they must advance the payment offered by the US insurance company to you. In doing so, they are not even taking on any risk at all because they can always recover the same amount from the at-fault driver's insurance company at a later date.

Where do You file the Underinsured or Uninsured Motorist Claim if the Accident Happened in the United States?

If you are an Ontario resident and the at-fault driver has insufficient insurance to pay your claim, you may have the ability to commence a claim for Underinsured or Uninsured motorist coverage from your Ontario auto policy. Even though the accident may have occurred in one of the United States, the underinsured claim is brought in Ontario. There are also time limits that you must adhere to in order to bring a underinsured motorist claim in Ontario.

Which Law Applies in the Underinsured Claim - Ontario or the State where the Accident Occurred?

The choice of law provisions on Underinsured or Uninsured motorist claims arising from a US accident are often misunderstood by insurance adjusters and even their lawyers. In short, the law of both jurisdictions will apply. The legal maxim to start with is that of Lex Loci Delicti - a Latin phrase that essentially means that the law of the location where the negligent conduct occurred. In the case of a Canadian injured in a Florida car accident the, we begin with the proposition that the law of Florida will apply even though the claim is advanced in an Ontario court. This is not the end of the story, however. The Ontario insurance contract provides that Ontario law on damages applies. Furthermore, even where Ontario courts apply a foreign law, the Ontario law on procedure will always apply. Canadian courts have held that Damages/Money awards are procedural law. So, in the context of a Canadian injured in the US, the Courts will apply the US law with respect to liability under the doctrine of Lex Loci Delicti, and will apply Ontario law on damages on the basis of the contract and the common law interpreting damages as procedural law.

What is the Deadline to File a Uninsured or Underinsured Claim?

The applicable statute of limitations for UIM claims and when the limitation begins to run has been the subject of considerable debate and legal analysis by the Courts. The leading case in Ontario is from the Court of Appeal decision in Schmitz v. Lombard General Insurance Company of Canada, 2014 ONCA 88. That case addressed the application of the Limitations Act to claims under OPCF 44R. In Summary, the Court of Appeal held that the limitation period for claims under OPCF 44R start to run on the day after a demand for indemnity is made.

The Ontario Insurance Act Deductible and Threshold Are Liability Law and Therefore Do Not Apply to a UIM Claim Arising from a US Accident

The most significant implication is that the Deductible and Threshold under Ontario law do not apply to Underinsured Claims arising out of US car accidents. Under Ontario law, if a person is injured in a car accident, their claim is subject to two highly prejudicial provisions of Ontario law, namely the Deductible and the Threshold. The Deductible literally reduces the value of the case by a subjective amount chosen by the legislature, which increases every year. Currently the deductible is around $40,000. The Threshold is a provision that takes the power away from juries in Ontario and gives Judges the authority to wipe out verdicts for pain and suffering and health care expenses if they are not satisfied that the injury rises to the level of a permanent and serious impairment. This highly prejudicial Ontario law gives insurance companies a second bite at the apple even where a jury has awarded money to an injured victim. Fortunately, for victims of accidents in the United States, these two provisions of Ontario law do not apply to the Underinsured Motorist claim. The State law counterpart, however, will apply. As such, if the State where the accident occurred has a similar law that law would be applicable as a liability provision under the doctrine of Lex Loci Delicti. In our experience, dealing with Canadians injured all over the United States, we have not encountered any provisions that are anywhere near as prejudicial to a car accident victims right to compensation as those that presently exist in Ontario law. The leading case on this subject is from the Ontario Court of Appeal in Chomos v. Economical Mutual Insurance Co. 2002 CarswellOnt 2692; see also, Green v. State Farm Mutual Automobile Insurance Co. 2009 CarswellOnt 3770.

Can I Claim Ontario Accident Benefits - PIP Benefits if Injured in an Accident in the USA?

Ontario residents with a valid Ontario auto insurance policy, or those otherwise covered under an Ontario auto insurance policy (ie. family member in your household) will usually have the ability to claim for Ontario Accident Benefits even if the car or motorcycle accident occurred in the United States. This is important because Accident Benefits provide coverage even if you are at fault. Accident Benefits provide coverage for medical expenses and lost income, among other things.

If Injured in an Accident in the United States, You Have the Right to Elect Benefits from Ontario or the US

When an Ontario resident is injured in a car accident in the United States, they have the right to elect between Ontario benefits or those of the jurisdiction (State) where the car or motorcycle accident occurred. The election is final, so it is important to make an informed decision. In many cases, the choice can have major consequences to your ability to access benefits for healthcare and income loss. It is important to seek the advice of an experienced lawyer before making an election of benefits.

Lawyer Referrals and Affiliations for Canadians Injured in the United StatesIn personal injury cases where the legal proceedings must be commenced in the United States, our personal injury law firm can refer you to personal injury, medical malpractice, product liability, and other attorneys in the United States. We have relationships with some of the leading personal injury law firms in the United States. Iacobelli Law Firm will also be able to co-counsel in order to coordinate efforts in Canada such as first party claims (PIP/Accident Benefits and UIM).

|

American Attorneys Welcome to Call for Advice

If you are an attorney in the United States representing an Ontario resident that was injured in your state, you may have questions about Canadian insurance benefits or claims, or other matters including OHIP and extended health subrogation,, etc. We welcome calls from US lawyers regularly, so feel free to call Andrew Iacobelli with any questions or inquiries. Andrew is always happy to communicate with colleagues in the United States, and often provides assistance and guidance to US lawyers representing Ontario Canadian residents.

Free Consultations for Canadians Injured in the United States

If you are unsure whether your claim needs to proceed in Ontario or the United States, contact Iacobelli Law Firm to speak with a personal injury lawyer. If you would like our assistance in locating an attorney in the Unted States, please call 416-900-1070 or 1-866-234-6093 or fill out our contact form here.

If you are an attorney in the United States representing an Ontario resident that was injured in your state, you may have questions about Canadian insurance benefits or claims, or other matters including OHIP and extended health subrogation,, etc. We welcome calls from US lawyers regularly, so feel free to call Andrew Iacobelli with any questions or inquiries. Andrew is always happy to communicate with colleagues in the United States, and often provides assistance and guidance to US lawyers representing Ontario Canadian residents.

Free Consultations for Canadians Injured in the United States

If you are unsure whether your claim needs to proceed in Ontario or the United States, contact Iacobelli Law Firm to speak with a personal injury lawyer. If you would like our assistance in locating an attorney in the Unted States, please call 416-900-1070 or 1-866-234-6093 or fill out our contact form here.

Free Consultation for Canadians Injured in the United States

If you are unsure whether your claim needs to proceed in Ontario or the United States, contact Iacobelli Law Firm to speak with an experienced cross-border accident lawyer today. If we are unable to assist directly, we may be able to introduce you to a colleague in the United States.

Call us 24 hours a day 7 days per week at 866-234-6093 or complete our online form to start your free consultation.

Call us 24 hours a day 7 days per week at 866-234-6093 or complete our online form to start your free consultation.